Chapter 5: Estimation and Hypothesis Testing of the CAPM#

Example 1: Estimate the CAPM Regression Equation#

This example demonstrates how to estimate the model:

Getting Started#

To run this example on your own you will need to install the BrooksEconFinLib package. This package houses all examples and associated data.

How to#

Step One: Load the data#

To start, load the relevant variables from the dataset using loadd() and a formula string.

To replicate this example, we will load the following variables:

Date - Observation date.

SandP - S&P 500 index.

USTB3M - Three month T-bill yields. (Note that our data has already been converted to monthly).

FORD - Stock prices.

GE - Stock prices.

MICROSOFT - Stock prices.

ORACLE - Stock prices.

// Create file name with full path

data_file = getGAUSSHome() $+ "pkgs/BrooksEcoFinLib/examples/capm.csv";

// Load all variables from the CSV file

data_org = loadd(data_file, "date(Date) + FORD + SandP + USTB3M");

// Print the first 5 rows

head(data_org);

Date FORD SandP USTB3M

2002-01-01 15.300000 1130.2000 0.14000000

2002-02-01 14.880000 1106.7300 0.14666667

2002-03-01 16.490000 1147.3900 0.15250000

2002-04-01 16.000000 1076.9200 0.14583333

2002-05-01 17.650000 1067.1400 0.14666667

Further reading: Data management guide

Function reference: getGAUSSHome(), head(), loadd()

Step Two: Transform data#

Our data transformation starts by defining a procedure to compute log returns and using that procedure to compute log returns of the SandP and FORD variables.

Previous versions of our lnDiff procedure removed the missing observation from the first element of the return value. This time we want to keep the missing observation, because it is more convenient to assign the entire column than a partial column.

We could just remove the call to packr() from the version of lnDiff in our previous example. However, we will use this chance to show you how to use optional inputs to GAUSS procedures.

/*

** Procedure to compute log differences

**

** The second input, '...', tells GAUSS

** that this procedure can accept extra

** optional inputs

*/

proc (1) = lnDiff(x, ...);

local x_diff, trim1;

// If an optional input is passed in,

// set 'trim1' equal to its value,

// otherwise set trim equal to 1.

trim1 = dynargsGet(1, 1);

x_diff = 100 * ln(x ./ lagn(x, 1));

// If 'trim1' is not equal to 0.

if trim1;

// Trim 1 row from the top

// and 0 from the bottom

x_diff = trimr(x_diff, 1, 0);

endif;

retp(x_diff);

endp;

// Create a new dataframe with the continuously

// compounded returns of 'FORD' and 'SandP'

trim_1 = 0;

returns = lnDiff(data_org[., "FORD" "SandP"], trim_1);

// Set the variable names

returns = asDF(returns, "ret_ford", "ret_sandp");

head(returns);

ret_ford ret_sandp

. .

-2.7834799 -2.0984861

10.273611 3.6080107

-3.0165414 -6.3384655

9.8147061 -0.91229691

We will finish our data preparation by computing the excess return of SandP and FORD and then combining all the variables into one dataframe named, data.

// Create a datframe with the excess return of 'SandP' and 'FORD', by

// subtracting 'USTB3M' from both return variables computed above

er = returns - data_org[.,"USTB3M"];

// The excess return variables will be in the same order

// as the return variables in 'returns'. So make sure the

// variable names are in the right order.

er = asDF(er, "erford", "ersandp");

// Add the 'Date' and 'USTB3M' variables to the front

// of 'data using the horizontal concatenation operator '~'.

data = data_org[.,"Date" "USTB3M"] ~ er ~ returns;

head(data);

Date ret_ford ret_sandp USTB3M erford ersandp

2002-01-01 . . 0.14000000 . .

2002-02-01 -2.7834799 -2.0984861 0.14666667 -2.9301466 -2.2451528

2002-03-01 10.273611 3.6080107 0.15250000 10.121111 3.4555107

2002-04-01 -3.0165414 -6.3384655 0.14583333 -3.1623748 -6.4842988

2002-05-01 9.8147061 -0.91229691 0.14666667 9.6680394 -1.0589636

Further reading:

Function reference: asdf(), dynargsGet(), loadd(), ln(), trimr()

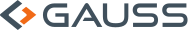

Step Three: Plot data#

We can create the above time series plot with the following code:

// Set size of graph

plotCanvasSize("px", 600 | 400);

// Declare plotControl structure

// and fill with default settings

struct plotControl plt;

plt = plotGetDefaults("xy");

plotSetYLabel(&plt, "ersandp/erford");

plotSetTitle(&plt, "Graph");

plotSetGrid(&plt, "on");

// Draw the plot using a formula string

plotXY(data, "ersandp + erford ~ Date");

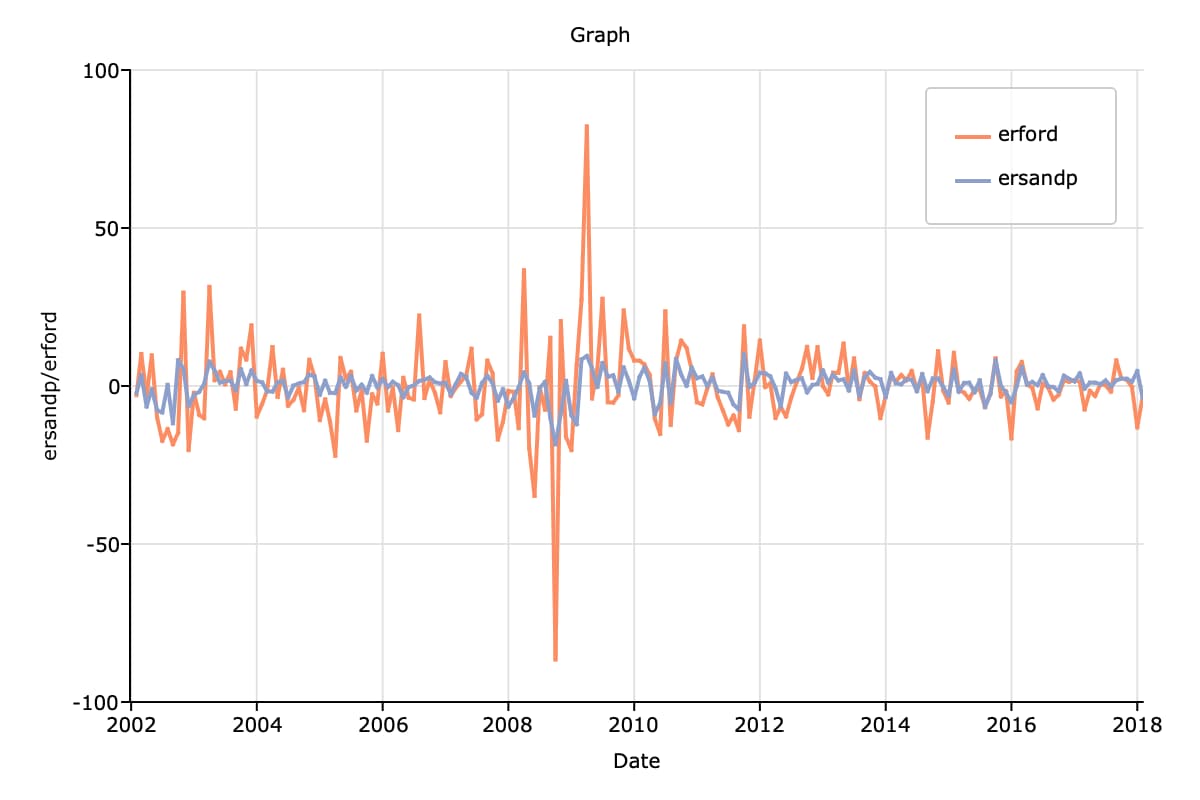

The code below will create the above scatter plot.

// Open a new graph window so we don't

// overwrite the graph we just created

plotOpenWindow();

// Fill 'plt' with default settings for scatter plots

struct plotControl plt;

plt = plotGetDefaults("scatter");

plotSetTitle(&plt, "Graph");

plotSetGrid(&plt, "on");

// Plot 'erford' vs 'ersandp' using a formula string

plotScatter(plt, data, "erford ~ ersandp");

Further reading: Basic GAUSS Graph Customization

Function reference: plotcanvassize(), plotgetdefaults(), plotOpenWindow(), plotScatter(), plotSetGrid(), plotSetTitle(), plotSetYLabel()

Step Four: Compute regression#

// Compute the regression:

// 'erford = a + B*ersandp + err

// and print results

call olsmt(data, "erford ~ ersandp");

Valid cases: 193 Dependent variable: erford

Missing cases: 1 Deletion method: Listwise

Total SS: 34741.345 Degrees of freedom: 191

R-squared: 0.337 Rbar-squared: 0.334

Residual SS: 23019.606 Std error of est: 10.978

F(1,191): 97.258 Probability of F: 0.000

Standard Prob Standardized Cor with

Variable Estimate Error t-value >|t| Estimate Dep Var

-------------------------------------------------------------------------------

CONSTANT -0.955984 0.793085 -1.2054 0.230 --- ---

ersandp 1.88976 0.19162 9.86197 0.000 0.580862 0.580862

Function reference: olsmt()